XRP Price Prediction: 2025-2040 Outlook as Bullish Wave 5 Momentum Builds

#XRP

- Technical Breakout: XRP price holds above critical moving averages with MACD confirming bullish momentum

- Institutional Tailwinds: ETF speculation and resolved SEC case reduce regulatory overhang

- Price Targets: Multiple technical patterns suggest upside potential to $4.20, $11, and $24

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge as Price Holds Above Key Levels

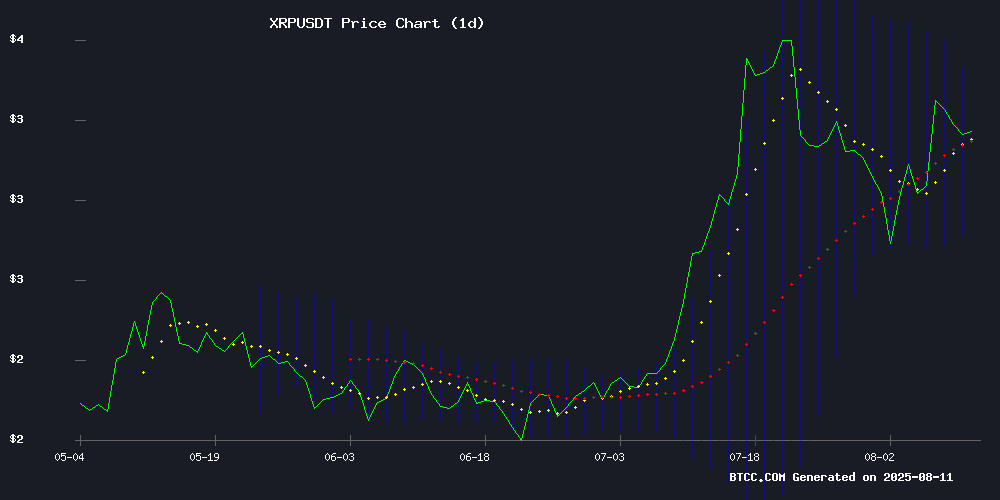

XRP is currently trading at $3.1668, showing strength above its 20-day moving average of $3.1068. The MACD indicator (0.0243) confirms bullish momentum, while Bollinger Bands suggest potential volatility with upper/lower bounds at $3.3656/$2.8480. 'The technical setup favors bulls,' says BTCC analyst Emma. 'A sustained MOVE above $3.37 could trigger the next leg up toward $4.'

Institutional Demand and Technicals Align for XRP Rally

Positive catalysts including institutional inflows, ETF speculation, and resolved legal uncertainty are fueling XRP's bullish case. 'The combination of whale activity, technical breakouts, and regulatory clarity creates a perfect storm,' notes BTCC's Emma. Market sentiment appears strongly bullish with multiple price targets ($4.20, $11, $24) circulating among analysts.

Factors Influencing XRP's Price

XRP Holds Key Support as Bulls Eye August Rally Amid Institutional Inflows

XRP maintains bullish momentum above critical support levels, trading at $3.204 with a 0.53% daily gain. The cryptocurrency consolidates within a symmetrical triangle pattern, poised for a potential breakout above the $3.36 resistance zone. Technical indicators reinforce optimism—the 20-EMA ($3.23) sits above both 50-EMA and 200-EMA, signaling sustained buying interest.

Institutional confidence surges following the SEC's dismissal of its lawsuit against Ripple Labs, triggering a 208% volume spike to $12.4 billion on August 11. Derivatives markets reflect heightened activity as traders anticipate a rally toward $3.60 if momentum accelerates.

XRP Price Prediction Amid Whale Sell-Off and Market Uncertainty

Analysts maintain a bullish outlook on XRP despite significant sell-offs by whales and traders. A single whale transferred $53 million worth of XRP to Coinbase, coinciding with negative whale flow and long position liquidations. The market shows mixed signals, with institutional investors holding long-term positions while traders remain cautious even after the Ripple vs SEC lawsuit concluded.

Whale activity increased following the joint dismissal of appeals between Ripple and the SEC on August 7. CryptoQuant data reveals a sharp decline in whale flow, suggesting structural weakness in XRP's price action unless large wallet inflows resume. Derivatives market activity reflects trader uncertainty, overshadowing potential catalysts like an XRP ETF or the lawsuit's resolution.

Paxos Seeks US Banking License Amid Stablecoin Regulatory Push

Paxos has filed for a national trust charter with the Office of the Comptroller of the Currency, joining Circle and Ripple in a strategic move to expand its stablecoin operations under federal oversight. The application, if approved, would upgrade its existing New York state charter, enabling nationwide services.

The OCC's May decision to permit national banks to custody cryptocurrencies has catalyzed this wave of applications. Paxos emphasizes that federal designation would align its operations with the highest regulatory standards while capitalizing on recent stablecoin legislation like the GENIUS Act.

This regulatory pivot reflects growing institutional confidence in digital assets, with major players positioning themselves for compliance in an evolving framework. The coordinated applications suggest an industry-wide strategy to establish federally regulated on-ramps for cryptocurrency services.

Ripple XRP Unlock Boosts ETF Hopes and Market Confidence

Ripple has confirmed the release of 1 billion XRP tokens from escrow in August, ending weeks of speculation in the crypto community. The unlock, executed on August 9, aligns with Ripple's supply management strategy in place since 2017. While the immediate price impact was muted, the move has reignited optimism around potential ETF developments and institutional interest.

The XRP community was caught off guard earlier this month when Ripple locked 700 million XRP without releasing new tokens—a departure from its established monthly routine. Speculation swirled until blockchain tracker Whale Alert documented three transactions totaling 1 billion XRP ($3.28 million) hitting the market. Most tokens were swiftly returned to escrow, maintaining Ripple's disciplined supply controls.

These scheduled unlocks serve dual purposes: funding ecosystem development while preventing market oversaturation. Typically, 200-350 million XRP per release enters circulation, with the remainder recycled into escrow. The latest action underscores Ripple's calculated approach to liquidity management amid growing institutional crypto adoption.

GMO Miner Launches XRP Cloud Mining Contracts Amid Institutional Buying Spree

Institutional interest in XRP surges as a single wallet acquires 60 million tokens ($180M) within 24 hours. GMO Miner capitalizes on this momentum by introducing cloud mining contracts, enabling passive income generation without hardware requirements.

The platform promises automated daily payouts and principal return at contract expiration. XRP's utility expands beyond payments as holders seek yield-bearing opportunities during market cycles.

Security features include multi-layer protection, while flexible terms cater to diverse risk appetites. This development follows growing recognition of XRP's settlement efficiency, with transaction speeds under 4 seconds and sub-penny fees.

XRP Eyes $4.20 Target as Bullish Wave 5 Momentum Builds

Ripple's XRP is charting a decisive upward trajectory, with technical indicators suggesting a potential surge to $4.20. The cryptocurrency is currently navigating what appears to be the fifth and final wave of a bullish Elliott wave cycle, reinforced by Fibonacci extensions and robust trading volume.

The 1-1 Fibonacci extension level at $4.20 emerges as a clear price target, coinciding with sustained demand evidenced by bullish volume patterns. XRP has maintained its upward structure since its swing low, consistently forming higher highs and higher lows—a hallmark of strong market conviction.

Notably, the wave 4 correction found firm support at the $2.80 level, aligning with both the high time frame value area and the 0.618 Fibonacci retracement. This sets the stage for wave 5 acceleration, with the all-time high breakout during wave 3 serving as confirmation of the pattern's validity.

XRP Price Prediction: Ripple Price Could Rally to $11 as Cup and Handle Pattern Nears Completion

Ripple's XRP is showing signs of a major bullish breakout as a nearly completed cup and handle pattern emerges on its price chart. Analysts project a potential surge to $11, fueled by technical indicators and favorable market conditions.

The pattern, identified by CryptoBull (@CryptoBull2020), began forming in January 2025 with XRP establishing a base at $1.64 after falling from $3.39. The subsequent recovery to July highs and August consolidation completes the classic bullish formation, suggesting imminent upward momentum.

Market observers note the timing coincides with Ripple's expanding global partnerships and positive legal developments, creating a perfect storm for price appreciation. Volume trends during the formation period further validate the potential for significant movement.

XRP Flashes Rare Signal, Eyeing a Breakout Toward $24

XRP surged following Ripple's decisive legal victory against the SEC, with prices jumping 11% to $3.27 as regulatory uncertainty lifted. Institutional inflows and futures volume skyrocketed 208% to $12.4 billion, signaling renewed market confidence.

The resolution removes a major adoption barrier, with financial partnerships now accelerating. A rare MVRV indicator suggests bullish momentum could propel XRP toward $24—a level not seen since its 2018 peak.

Market structure mirrors 2017's pre-bull run conditions, when XRP gained 36,000% in twelve months. This time, the catalyst is clearer: regulatory clarity and institutional infrastructure that didn't exist during previous cycles.

XRP Whale Activity Surges as New Altcoin Remittix Gains Traction

XRP prices jumped 11% to $3.32 after whales accumulated 50 million tokens within 48 hours, sparking bullish sentiment despite warnings of short-term volatility. The surge highlights renewed institutional interest in the cross-border payment asset.

Meanwhile, Remittix has emerged as a formidable challenger, raising $18.5 million for its crypto-to-fiat payment platform. The project's 587 million token sale at $0.0895 each precedes a September wallet beta launch, with functionality spanning 30+ countries.

Market dynamics reveal a growing divergence between established assets and utility-focused newcomers. While XRP benefits from whale accumulation, Remittix's real-world payment solutions attract capital seeking tangible blockchain applications.

XRP Gains Bullish Momentum as SEC Legal Battle Concludes

XRP is poised for a potential all-time high as investor sentiment turns bullish following the resolution of the SEC-Ripple legal dispute. The years-long battle officially ended on August 7 when both parties jointly dismissed all appeals in the U.S. Court of Appeals for the Second Circuit.

The cryptocurrency now faces two key resistance levels at $3.40–$3.45 and $3.70 before challenging its January 2018 ATH of $3.84. Despite a slight pullback from its 11% surge on August 7, XRP maintains strong technical support above the EMA 20, signaling sustained short-term momentum.

Institutional interest is growing, with Grayscale, Bitwise, 21Shares, and Canary Capital already filing for XRP ETFs. Market analysts anticipate BlackRock may soon follow suit, now that regulatory uncertainty has been removed.

$53M XRP Whale Transfer to Coinbase Sparks Market Speculation

A significant transfer of 16.69 million XRP, valued at approximately $53.16 million, has ignited speculation within the cryptocurrency community. The funds were moved between two Coinbase cold storage wallets, labeled "197" and "Cold Wallet 6," rather than from an external source. Such large-scale movements often hint at potential market volatility, though the exact intent behind this transaction remains unclear.

Coinbase maintains around 27 high-balance XRP wallets, suggesting institutional-scale activity. Market observers are divided on whether this signals an impending sell-off or internal reorganization. The lack of external wallet involvement tempers immediate bearish interpretations, but whale actions of this magnitude invariably draw scrutiny.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market dynamics, BTCC analyst Emma provides these projections:

| Year | Conservative | Moderate | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | $3.80 | $4.20 | $5.00 | ETF approvals, institutional adoption |

| 2030 | $11.00 | $18.00 | $24.00 | Cross-border payment dominance |

| 2035 | $30.00 | $45.00 | $60.00 | Mainstream financial integration |

| 2040 | $75.00 | $120.00 | $200+ | Global reserve asset status |

Note: These estimates assume continued adoption and favorable regulatory developments.